Insurance is priced to reflect the underlying risk of every policy. When more claims are filed and the average amount paid of those claims increases, insurance becomes more expensive. A measure of underwriting profitability for insurance carriers is the combined ratio calculated as losses and expense divided by earned premium plus operating expenses divided by written premium. A combined ratio over 100 represents an underwriting loss. When expected losses increase, an insurance carrier must increase premiums by raising rates to maintain a combined ratio under 100.

Commercial auto insurance has recorded a net combined ratio over 100 nine times out of 10 between 2014 and 2023, and, according to the latest forecasting report by Triple-I and Milliman, continues to worsen in 2024. According to the Triple-I Issues Brief, personal auto insurance has had a net combined ratio over 100 for the past three years, with a 2023 net written premium (NWP) growth of 14.3 percent, which was the highest in over 15 years.

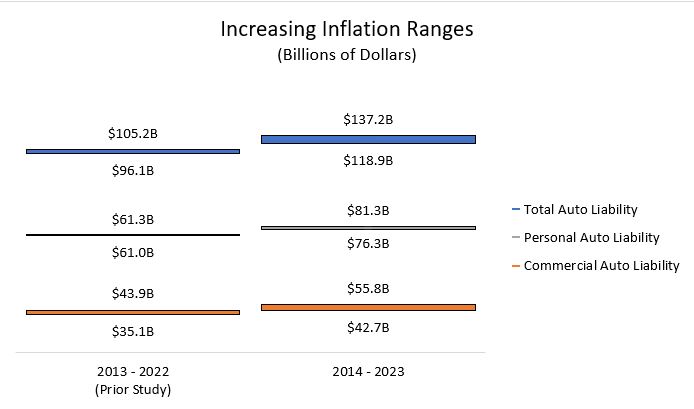

From 2014 through 2023 economic and social inflation added $118.9 billion to $137.2 billion in auto liability losses and defense and cost containment (DCC) expenses. This represents 9.9 percent to 11.5 percent of the $1.2 trillion in net losses and DCC for the period and an increase of 24 percent to 31 percent from the previous analysis on years 2013 through 2022.

A new study – “Increasing Inflation on Auto Liability Insurance – Impact as of Year-end 2023” – is the fourth installment of research on the impact of economic and social inflation on insurer costs and claim payouts. Compared to the prior study, Commercial Auto Liability loss and DCC is 20.7 percent to 27.0 percent ($43 billion to $56 billion) higher due to increasing inflation. Personal auto liability loss and DCC is 7.7 percent to 8.2 percent ($76 billion to $81 billion) higher from increasing inflation.

Key Takeaways

- The compound annual impact of increasing inflation ranges from 2.2 percent to 2.9 percent for commercial auto liability, which is higher than the personal auto liability estimate of 0.7 percent. However, the impact of increasing inflation from a dollar perspective is much higher for personal auto liability compared to commercial auto liability. This is due, in part, to the underlying size of the line of business.

- Frequency of auto liability claims per $100 million GDP for 2023 is unchanged for commercial auto liability and lower for personal auto liability compared to 2020, when frequency dropped at the onset of the COVID-19 pandemic for both lines.

- Severity of auto liability claims continues to increase year over year and has increased more than 70 percent from 2014 to 2023 for both lines.

- The importance of having a knowledgeable independent insurance agent has never been more important than now. By understanding the current marketplace we can provide the best options and insight to our customers.